What Do You Need to Know Before You Get Into Buying Warehouses?

Investing in warehouses presents a promising opportunity, especially with the rising demand for logistics and storage solutions in today’s fast-paced economy. As e-commerce, supply chain networks, and industrial expansion continue to grow, warehouses have become a valuable asset in commercial real estate investing.

However, purchasing a warehouse is far more complex than acquiring a residential or standard commercial property. It requires in-depth market research, strategic planning, and a solid understanding of factors such as location, infrastructure, tenant demand, and operational costs. Warehouses can generate steady rental income and long-term capital appreciation. Here’s what to consider before diving in:

8 points to remember Before You Get Into Buying Warehouses

1. Location Is Key

Location plays a crucial role in determining the success of your warehouse investment. Consider these factors:

- Proximity to highways, railways, airports, and ports for easy transportation.

- Access to industrial hubs and major cities where logistics demand is high.

- Availability of labor and ease of employee commute.

- Infrastructure developments and future growth potential of the area.

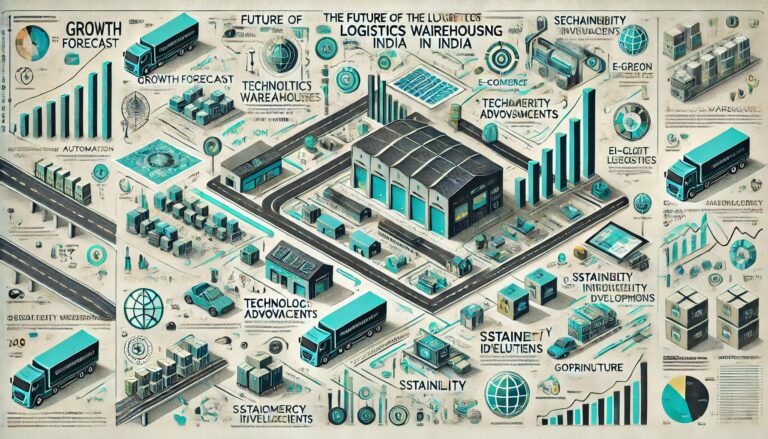

2. Warehousing in Delhi: A Booming Market

With its strategic location, well-connected transportation network, and high demand for logistics, investing in a warehouse in Delhi NCR can yield strong returns. Key factors to consider in Delhi’s warehousing market include:

- Prime Locations: Areas like Mundka, Alipur, Bawana, and Narela are popular warehouse destinations in Delhi NCR due to their proximity to highways and industrial clusters. Companies like TownAcre in Okhla Industrial Park have established themselves as key players in providing warehousing solutions in the region.

- Logistics and Connectivity: Delhi’s seamless connectivity to NCR (Noida, Gurgaon, Faridabad) and major highways like NH-1, NH-8, and NH-24 make it an attractive choice.

- E-commerce Boom: The rise of e-commerce giants like Amazon and Flipkart has surged the need for storage, fulfillment centers and warehouses in and around Delhi.

- Cost Considerations: While Delhi itself has high land costs, investing in the outskirts or nearby areas like Sonipat and Manesar can be a cost-effective alternative.

- Top Real Estate Companies in Delhi: Many top real estate companies in Delhi have recognized the growing need for warehouses and are investing heavily in them.

3. Understand Market Demand

Before purchasing a warehouse, assess the demand in the area:

- Research vacancy rates and rental yields.

- Analyze industry trends such as e-commerce growth, which drives warehouse demand.

- Consider the types of businesses operating nearby that may require storage facilities.

- Check out a commercial building for sale in Delhi that aligns with your business needs and investment goals.

4. Choose the Right Type of Warehouse

Warehouses come in various types, and selecting the right one depends on your investment goals:

- Storage Warehouse – Basic storage space for goods and raw materials.

- Distribution Center – Requires good connectivity and efficient logistics management.

- Cold Storage – Specialized warehouses for perishable goods, requiring high-tech cooling systems.

- E-commerce Fulfillment Centers – Designed for fast-moving inventory and high automation.

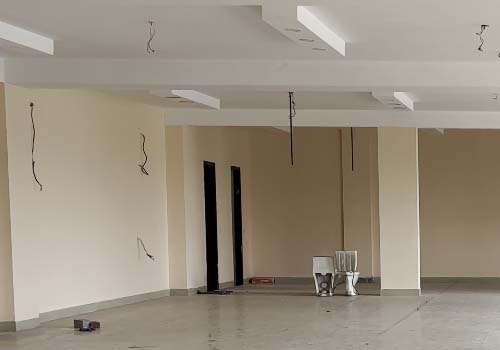

5. Evaluate Property Specifications

Check if the warehouse meets essential requirements:

- Size & Layout: Ensure adequate storage space with future scalability.

- Ceiling Height: Higher ceilings allow vertical stacking, maximizing storage.

- Loading Docks: Proper dock height and accessibility ease the movement of goods.

- Floor Load Capacity: Must support heavy-duty machinery and goods.

- Fire Safety & Security: Equipped with fire suppression systems and security features.

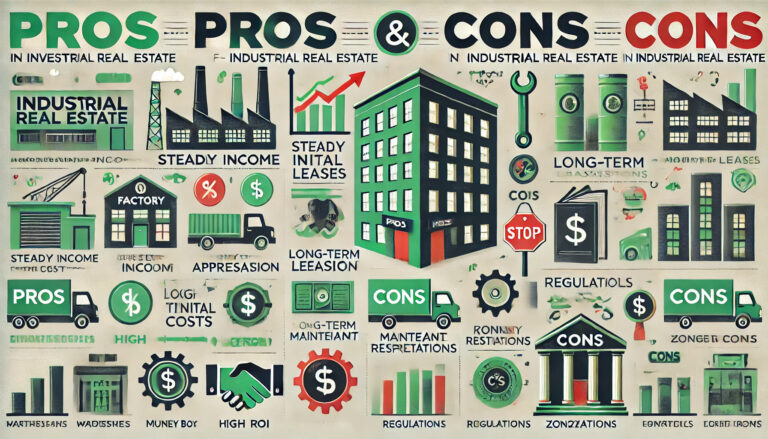

6. Legal & Regulatory Considerations

Before finalizing a purchase, ensure compliance with legal and zoning requirements:

- Zoning Laws: Confirm that the property is legally designated for warehouse use.

- Title & Ownership Clarity: Verify clear land title and ownership records.

- Environmental Regulations: Ensure the land is free from contamination or environmental liabilities.

7. Financial Planning & Investment Returns

A warehouse purchase is a significant investment, so financial planning is crucial:

- Purchase vs. Leasing: Decide whether buying or leasing aligns with your financial goals.

- Return on Investment (ROI): Assess rental income, appreciation potential, and operational costs.

- Maintenance Costs: Account for upkeep, insurance, and property taxes.

- Financing Options: Explore bank loans, real estate investment trusts (REITs), or investor partnerships.

8. Deciding the Purpose of Your Warehouse

Before investing, define how you plan to utilize your warehouse:

- Rental Income: Leasing your warehouse to businesses can provide a steady income stream. Research potential tenants, lease agreements, and rental demand in your area. Companies like TownAcre in Okhla Industrial Park specialize in offering rental warehousing solutions, making it easier for investors to find tenants.

- Own Operations: If you have a business that requires storage, operating your own warehouse might be a cost-effective solution.

- Transitional vs. Storage Warehouse: Decide whether your warehouse will act as a third-party logistics (3PL) facility, handling inventory transitions, or if it will store materials for long-term use.

- Type of Goods to Store: Different warehouses cater to different needs, such as:

- General goods and dry storage

- Cold storage for perishable items

- Hazardous material storage requiring special safety measures

- High-value goods needing extra security

TownAcre: Your Gateway to Smart Warehousing Investments

Investing in a warehouse is more than just acquiring a property; it’s about positioning yourself for long-term success in the evolving industrial landscape. If you are looking for a commercial building for sale in Delhi or planning to invest in a warehouse in Delhi, choosing the right location and developer is key.

TownAcre in Okhla Industrial Park is setting new benchmarks in warehouse infrastructure. With cutting-edge facilities, strategic connectivity, and a business-friendly environment, TownAcre is an excellent choice for those looking to make a profitable commercial real estate investing move. Whether you’re an entrepreneur seeking operational efficiency or an investor looking for high returns, TownAcre offers the perfect blend of innovation and reliability.

FAQs:

q. 1. What are the requirements for a warehouse?

Ans. It should have ample natural light and be well-ventilated. Ideally, it should have a minimum of 10% to 15% natural light.

q.2. Is it worth investing in warehouses?

Ans. Strong and Stable Returns: One of the biggest reasons for investing in warehouses is the potential for strong and stable returns, particularly in commercial real estate investing.