Pros and Cons of Investing in Industrial Real Estate

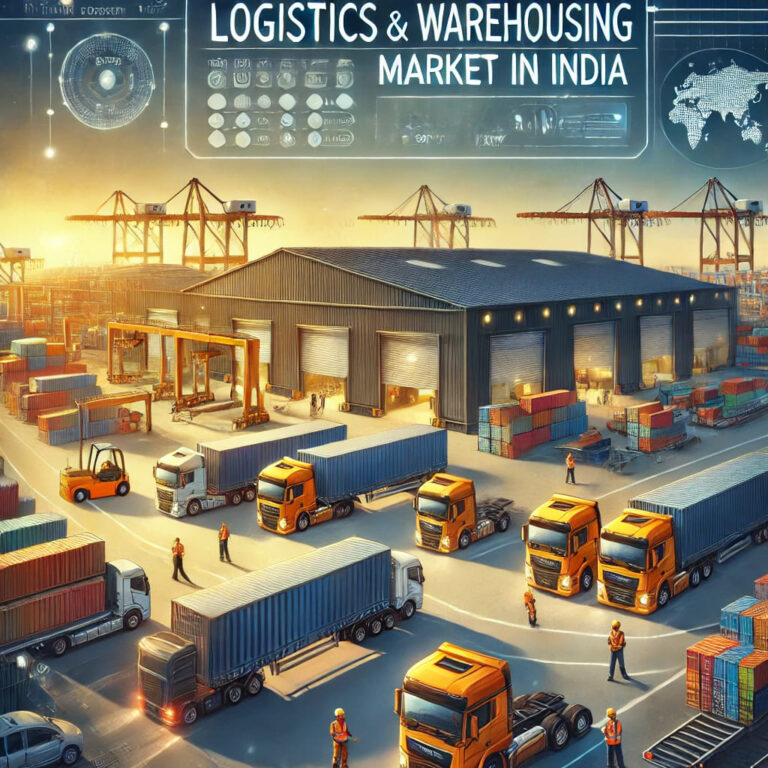

The industrial real estate sector is undergoing a remarkable transformation. Driven by the expansion of e-commerce, robust infrastructure development, and strategic government initiatives, investing in industrial real estate has gained significant traction in recent years. In India, the industrial real estate sector accounted for 30% of total real estate investments in 2024, underscoring its growing prominence.

The Delhi National Capital Region (NCR), with its booming commercial property in Delhi, has emerged as a focal point for real estate investments. In the first half of 2024, Delhi-NCR attracted $633.3 million in private equity investment, leading the country in real estate investment inflows.

This growth highlights the region’s potential as a hub for industrial real estate and as a prime destination for those seeking to partner with the best real estate company in Delhi for lucrative investment opportunities.

Pros of Investing in Industrial Real Estate

There are multiple benefits as to why one should consider investing in industrial real estate. Let us look at a few key advantages of industrial real estate investment:

1 Steady Income: Unlike residential properties, industrial real estate properties are usually leased out for longer periods say 5-10 years. Since the tenants are usually businesses with established financial stability, it ensures a steady cash flow and a stable income.

2. Limited Tenant Turnover: Industrial tenants tend to have lower turnover rates compared to residential tenants. It is costly and logistically challenging for a company to relocate and reconfigure its operations in a new facility. Therefore, there is less incentive for firms to change locations very frequently. This means investors in industrial properties enjoy longer durations of tenant occupancy and a lower risk of vacancy.

3. Potential for Appreciation: The value of industrial real estate appreciates over time due to the increasing demand, limited supply of industrial land, and improvement in infrastructure. A DSIDC, such as the Okhla Industrial Area in Delhi, with its proximity to a highway or port, increases the value of the property, therefore making it a good long-term investment.

4. Diverse Options: Among industrial real estate, there are diverse options, such as warehouses, cold house storage, manufacturing units, distribution units, data centers, etc. Investors have the freedom to choose from these based on market trends, the location of the property, the amount of risk willing to take, the economy’s performance, etc.

5. Growing Market: The market for industrial real estate has seen significant growth. Global trends such as the rise of e-commerce, the need for efficient supply chains, and localized manufacturing have significantly boosted demand for industrial spaces. With these trends, the demand for industries is likely to flourish.

6. Triple Net Lease: Industrial properties are typically leased out on a Triple Net Lease basis which means the tenant is responsible for any property repairs, insurance costs, taxes, and the rent, thus lower maintenance for the investor.

Cons of Investing in Industrial Real Estate

While industrial real estate offers numerous advantages, it also comes with certain challenges. Here are some of the key disadvantages:

1. Professional Help: Investing in industrial properties requires some industry-specific knowledge. Knowledge of zoning regulations, environmental factors, and infrastructure needs is essential to penetrate the complexity of this sector. It is vital to conduct due diligence, which involves understanding market trends, tenant quality, and the condition of the property before making investment decisions. In the absence of such knowledge in industrial real estate, risks are increased in property acquisition and management. It is better to hire professional help, especially if you are a first-time investor.

2. Higher Initial Investment: Industrial properties tend to be a more capital-intensive investment compared to residential property. The amount of money needed to buy or develop industrial space, along with infrastructure and maintenance, can be high. Investors should have adequate capital or the ability to secure financing sources to participate in this kind of investment.

3. Location Sensitivity: Industrial real estate investments are highly location-specific. A property in an unfavorable location or a poorly connected region may not attract enough tenants, and hence stay empty for a longer time period. Proximity to the transportation hubs, supply chains, and consumer markets is a must, and failure to achieve them can greatly affect the property’s value and the amount of rental demand for that property.

4. Vacancy Risk: Most industrial properties are designed for particular uses, so when one tenant moves out, finding another becomes difficult. Vacancy periods may become more prolonged. Along with no rental income, the burden for all maintenance and other expenses falls under the owner’s responsibilities. The risk is further magnified during economic downturns or shifts in industry demand.

Why is Delhi-NCR a Prime Market for Industrial Real Estate?

Delhi-NCR has become one of the most sought-after locations for industrial real estate investment due to its strategic advantages. With well-established infrastructure, including international airports, extensive roadways, and rail networks, the region offers exceptional connectivity that supports efficient logistics and supply chain management.

This connectivity, combined with the region’s thriving manufacturing sector, positions Delhi-NCR as an ideal location for businesses requiring industrial spaces such as warehouses, distribution centers, and manufacturing units.

The demand for commercial property in Delhi is rapidly increasing as e-commerce, logistics, and manufacturing industries continue to expand. Delhi’s proximity to major markets, coupled with the government’s favourable industrial policies, has further strengthened its appeal as a prime investment destination for industrial properties.

TownAcre is Here to Guide

Investing in industrial real estate has numerous opportunities because it yields high rental benefits, long-term appreciation for properties, and tax benefits. This is, however, not to mention that some risks are involved including location sensitivity and the chances of facing vacancy risks as with any investment.

Despite these odds, the industrial real estate sector continues to thrive with the emerging needs for logistics, e-commerce, and manufacturing facility use.

For those looking to make the most of the opportunities in this lucrative market, TownAcre, in the Okhla Industrial Area, stands out as the best real estate company in Delhi. With extensive experience and in-depth market knowledge, TownAcre provides expert guidance, helping investors make informed decisions in the dynamic industrial real estate sector.

Whether you are a first-time investor or a seasoned professional, with TownAcre’s customized approach and extensive market knowledge, you can confidently tap into the vast potential of Delhi-NCR’s industrial real estate sector and make informed, profitable decisions for long-term growth.

FAQs

Q. Is it good to invest in industrial land?

Ans. Purchasing industrial plots is an excellent method of expanding the size of your real estate investment. This is quite unlike the situation that happens with residential and/or commercial markets whereby market changes or even recessions will influence the market for the industrial property.

q. Is industrial land cheaper than residential?

Ans. Commercial properties often yield higher rental incomes per square foot compared to residential properties. However, the initial investment and operational costs in commercial real estate are usually higher.