Future of Logistics: Warehousing Market in India

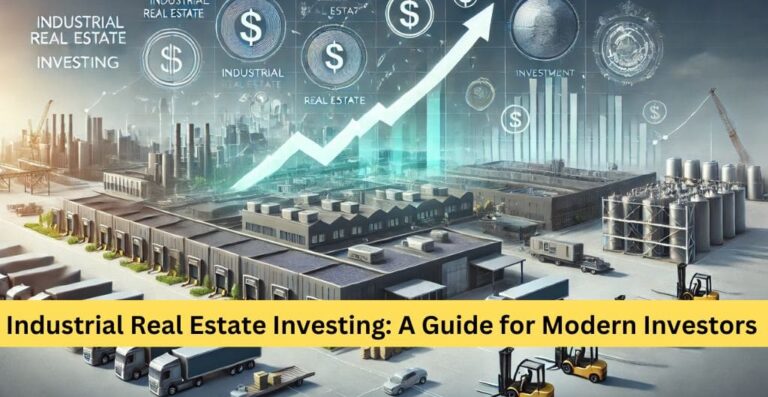

As we look towards 2025, India’s logistics and warehousing sector stands on the cusp of transformative growth. Driven by technological advancements, evolving market demands and supportive government policies, this sector promises exciting opportunities for investors, developers and businesses.

In India, particularly in Delhi, industrial real estate is emerging as a robust investment avenue. Reports by firms like Cushman & Wakefield and Colliers India highlight significant potential and ongoing developments in this sector. Let’s explore the key trends shaping the future of industrial real estate.

E-commerce Expansion Driving Demand

One of the most significant drivers of growth in the warehousing market is the exponential rise of e-commerce. Companies are investing heavily in warehousing and fulfillment centers to meet the growing demand for faster deliveries. Locations like Okhla in South Delhi have emerged as prime spots for setting up modern warehousing facilities due to their strategic connectivity and proximity to urban markets.

Technological Advancements and Automation

The integration of automation, robotics, and IoT-enabled systems is revolutionizing warehousing operations. These advancements enhance efficiency, reduce costs and improve inventory management. Real estate developers in Delhi are incorporating advanced technologies in new projects, making automated storage and retrieval systems (ASRS) and real-time tracking tools standard features in warehouses. This technological shift is critical for businesses seeking reliable and efficient warehousing solutions.

Sustainability and Green Infrastructure

Sustainability has become a top priority in the logistics sector. There is a growing demand for green industrial spaces, with developers focusing on energy-efficient designs, renewable energy integration and waste management systems.

In regions like Delhi, this shift is particularly evident, where environmental concerns are driving the push for eco-friendly solutions. Green-certified warehouses and factories equipped with solar panels, rainwater harvesting systems and energy-efficient lighting are now common features.

Cold Storage Facilities

The rise in online grocery shopping and the expansion of the pharmaceutical industry are driving the demand for cold storage facilities. As a major distribution hub, Delhi is witnessing a surge in the development of temperature-controlled warehouses. Areas like Okhla and companies like Townacre are at the forefront of this growth, offering state-of-the-art facilities for industries that require specialized storage solutions.

Multimodal Logistics Parks (MMLPs)

The development of MMLPs is a game-changer for the warehousing market. These parks are designed to lower overall freight costs, cut warehousing expenses and improve the tracking and traceability of consignments. MMLPs provide facilities like mechanized warehouses, cold storage and container terminals, creating integrated spaces that attract investments in modern warehousing facilities.

Dedicated Freight Corridors (DFC)

The Dedicated Freight Corridor project aims to separate freight and passenger traffic on high-density routes, enhancing operational efficiency and reducing costs. This project increases the demand for warehouses along the corridors, ensuring seamless goods movement and storage.

Port and Sea Transportation

With the Sagarmala Program enhancing port infrastructure and promoting coastal shipping, there is a higher demand for coastal warehouses and distribution centers. This approach significantly reduces inland logistics costs and improves efficiency, creating a positive impact on the warehousing market.

Airport Growth

The expansion and modernization of airports are boosting air cargo capacity, driving the need for specialized warehousing near airports. These facilities serve as air cargo hubs, ensuring efficient goods handling and storage.

Investment Opportunities

The evolving logistics landscape is attracting significant investments in the warehousing sector. Reports by Cushman & Wakefield and Colliers India highlight the resilience and growth potential of the market despite macroeconomic challenges. Investors are keen on developing and upgrading warehousing facilities to cater to new demand.

Government Initiatives and Policy Support

Government initiatives such as the National Logistics Policy and the Gati Shakti Program are set to enhance the efficiency of supply chains and reduce logistics costs. These policies encourage the development of industrial corridors and logistics parks in key areas, including South Delhi.

Moreover, the Production-Linked Incentive (PLI) schemes are attracting global manufacturers to set up their facilities in India, presenting opportunities for real estate developers to cater to the rising demand for high-quality industrial spaces.

How TownAcre can help

The future of logistics and the warehousing market in India looks promising. Trends such as e-commerce expansion, technological integration, sustainability and strategic government initiatives are shaping the sector. The evolving landscape of industrial real estate is not just about spaces but creating value-driven solutions that cater to the dynamic needs of businesses in 2025 and beyond.

For businesses interested in exploring commercial property for sale in South Delhi, partnering with a reputed real estate developer or a trusted real estate service provider can be the key to success.

Companies like TownAcre in Okhla Industrial Park stand out as prime locations for businesses and investors seeking growth opportunities. With cutting-edge facilities, seamless connectivity and strategic location it provides an attractive hub for modern warehousing solutions.

We believe that understanding these trends and leveraging the right opportunities can unlock significant value in the dynamic landscape of logistics and warehousing.

FAQs

q.1. What is the future of warehousing in India?

Ans. The Indian warehousing sector is on the brink of a remarkable transformation. As supply chains evolve, the demand for warehouse space is projected to reach approximately 1.2 billion sq. ft by 2027 across Grade A, B & C warehouses across all Indian cities.

q.2. What is the future of warehousing?

Ans. In the future, warehousing will become increasingly automated and digitized, resulting in improved process efficiency. Automated storage and retrieval systems, as well as advanced warehouse management systems, will help to ensure accuracy and free up staff to focus on higher-value tasks.

q.3. What is the future of the logistics industry in India?

Ans. As per a recent report, the Indian logistics industry logistics market is estimated to grow at 8.8 percent annually to USD 484.43 billion by 2029 from USD 317.26 billion in 2024 due to technological advancement.