Industrial Real Estate Investing: A Guide for Modern Investors

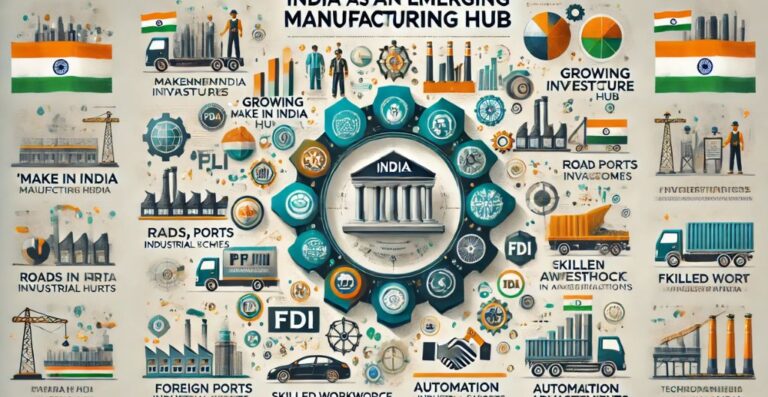

In the world of real estate, industrial properties have become a lucrative and stable investment option. With the rise of e-commerce and technological advancements, the demand for industrial real estate investing is on the rise.

For modern investors looking to diversify their portfolio and achieve steady returns, industrial real estate presents an attractive opportunity. This guide will help you navigate the complexities of industrial real estate investing and make informed decisions.

Understanding Industrial Real Estate

Industrial real estate includes properties used for manufacturing, production, storage and distribution. These properties range from warehouses and distribution centers to manufacturing plants and research and development facilities. The sector has shown resilience and growth potential, making it a solid investment choice.

Key Considerations for Modern Investors

Market Research and Location

Research the current trends and market conditions in the industrial real estate sector. Look for regions with strong economic growth, favorable government policies and robust infrastructure. The location of the property is crucial. Proximity to major transportation hubs and access to labor markets are important factors to consider.

Financial Evaluation

Evaluate the project’s financial viability by reviewing detailed cost estimates, revenue projections and cash flow analysis. Calculate key metrics such as Net Present Value (NPV), Internal Rate of Return (IRR) and Payback Period to assess the investment’s potential.

Types of Investment: Equity vs. Debt

Equity investments involve buying an ownership stake in the property. This can include direct property ownership, investing in Real Estate Investment Trusts (REITs), or participating in private equity funds.

Equity investors benefit from property appreciation and rental income. On the other hand, debt investments involve lending money to property owners or developers, usually in the form of mortgages or bonds. Debt investors earn regular interest payments and have a lower risk compared to equity investments, as they are often secured by the property.

Investment Vehicles

Investment vehicles for industrial real estate include Real Estate Investment Trusts (REITs), private real estate funds, crowdfunding platforms and fractional ownership. REITs allow investors to gain exposure to industrial real estate without the need to directly manage properties, while private real estate funds pool money from multiple investors to invest in industrial properties.

Crowdfunding platforms enable individual investors to invest in industrial projects with relatively small amounts and fractional ownership involves purchasing a portion of a property.

Key Documents and Legal Considerations

Before investing, it’s crucial to review both legal and financial documents to ensure a sound investment. Important legal documents include the title deed, property PID number, city survey sketch, updated tax receipts, property drawings, foundation certificate, building approval plan, zoning compliance, encumbrance certificate and occupancy certificate.

Financial documents to examine include financial statements, rent rolls, operating expenses, capital expenditure plans, loan documents, tax returns, insurance policies, valuation reports, environmental reports and lease agreements. Thorough due diligence will help identify potential risks and ensure compliance with legal requirements.

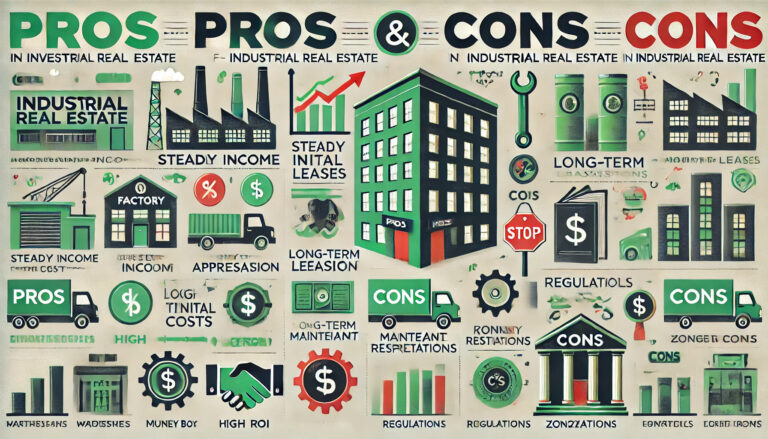

Risks in Industrial Real Estate Investments

Investing in industrial real estate comes with certain risks, such as construction delays, cost overruns, legal issues, market conditions and tenant vacancies. Projects can face delays due to regulatory approvals, labor shortages or supply chain issues. The actual cost of construction may exceed the initial budget, impacting the financial viability of the project.

Disputes with contractors, suppliers or regulatory authorities can lead to legal complications. Changes in market conditions can affect the demand for industrial space, impacting rental income and property values. Additionally, finding tenants for newly constructed properties can take time, leading to periods of vacancy and reduced income.

Rating Agencies for Investment Evaluation

Several firms provide certifications and ratings for industrial real estate assets and developers, similar to credit rating agencies.

Notable ones include CRISIL, which provides developer grading and project star grading; CARE Ratings, offering developer and project ratings; ICRA, providing ratings for real estate developers and projects; MSCI, providing real estate benchmarking and analytics; S&P Global Ratings, assessing the creditworthiness of real estate companies and projects; and Moody’s, offering credit ratings and research for real estate investments.

These firms help investors evaluate the quality and potential risks of industrial real estate investments.

Firms Providing Investment Services

Several firms offer services to help investors navigate the industrial real estate market in India.

These include Savills India (industrial consulting, transactions, investment advisory, project management), JLL India (property valuation, investment advisory, asset management, market research), Edelweiss India (alternative investment funds, real estate credit solutions, investment advisory), Strataprop (fractional ownership, investment in Grade-A commercial real estate, high-yield assets), Assetmonk (real estate investment, portfolio management, investment advisory) etc.

These firms provide valuable expertise and resources to help investors make informed decisions.

Making the Investment Decision

To make a well-informed decision, consider your risk tolerance, investment horizon and financial goals. Diversify your portfolio to spread risk across different asset classes, including industrial real estate, stocks, bonds and cash. Regularly review and adjust your portfolio based on changing market conditions and personal circumstances.

With careful planning, thorough research and a clear investment strategy, modern investors can achieve their financial goals and build a robust investment portfolio.

Conclusion

Industrial real estate investing offers a compelling combination of stability, growth potential and diversification. Whether you’re seeking steady income, capital appreciation or portfolio diversification, industrial real estate is undoubtedly a promising option.

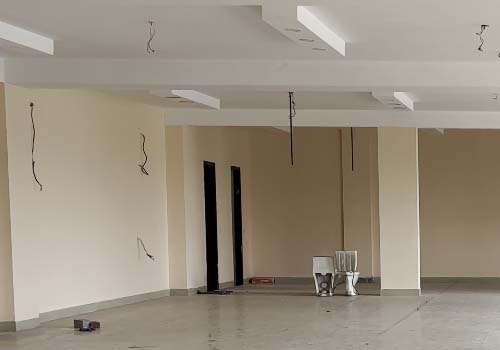

In 2025, Delhi’s industrial zones are set to show pivotal growth in businesses. Each of these top 5 zones caters to different industrial needs. Whether it’s the affordability of Bawana or the connectivity of Okhla, these zones cater to diverse industrial needs.

For those looking to invest in these promising areas, TownAcre in Okhla Industrial Area offers tailored industrial solutions with expert consultation and cutting-edge facilities, ensuring your business thrives in this evolving market.