Industrial and Logistics Real Estate: A High-Growth Investment Opportunity

The real estate sector in India is rapidly changing, and one of the fastest-growing segments is industrial and logistics real estate. The surge in e-commerce, the modernization of supply chains, and government-led infrastructure initiatives are key drivers of this growth. This sector presents a highly lucrative investment opportunity, attracting investors and developers eager to capitalize on the expanding demand for logistics spaces.

Real estate firms in Delhi, among others, are actively seeking opportunities in this space, particularly in regions like Delhi NCR, which is emerging as a logistics hub. The region’s strategic location and improved connectivity make it a prime destination for industrial growth.

Understanding Industrial and Logistics Real Estate

Industrial and logistics real estate includes properties designed for manufacturing, warehousing, distribution, and fulfillment operations. It is broadly categorized into:

- Warehouses and Distribution Centers – Essential for storage and inventory management, these facilities are in high demand, particularly for e-commerce and retail businesses. Warehouses in Delhi NCR are witnessing significant investment due to their strategic location and connectivity.

- Manufacturing Facilities – These properties cater to sectors like automotive, pharmaceuticals, and FMCG.

- Cold Storage and Specialized Logistics – Required for perishable goods, food products, and pharmaceuticals.

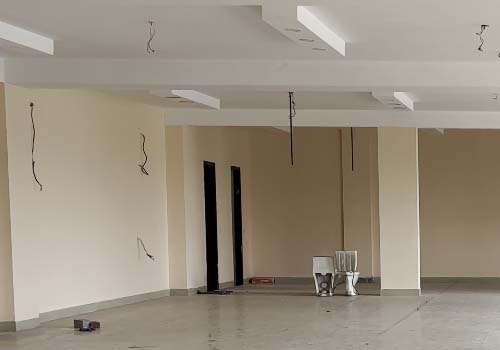

- Industrial Parks and SEZs – Large-scale zones that provide infrastructure and regulatory benefits for manufacturing and logistics companies. TownAcre in Okhla Industrial Park is an excellent example of an emerging industrial hub that meets these needs with modern facilities.

Key Drivers of Growth in Industrial and Logistics Real Estate

- Expansion of E-commerce and Retail

The rapid rise of online shopping has led to an increased demand for fulfillment centers and last-mile delivery hubs. Companies are investing in strategically located warehouses in Delhi NCR to enhance their supply chain efficiency. - Infrastructure Development and Government Policies

The Indian government’s initiatives, like Bharatmala, Gati Shakti, and the development of dedicated freight corridors, are improving connectivity between industrial hubs and metro cities. This is making investments in logistics real estate more attractive for real estate firms in Delhi and other metropolitan regions. - Rising Foreign Direct Investment (FDI) and REITs

Industrial and logistics real estate has become a preferred asset class for institutional investors and real estate firms in Delhi. REITs (Real Estate Investment Trusts) focused on warehousing and logistics are opening new avenues for investment. - Strategic Location Advantage of Delhi NCR

- Delhi NCR serves as a key gateway for northern India’s supply chain, making it a prime location for warehouses and industrial hubs. Businesses looking to establish a warehouse in Delhi NCR benefit from excellent road connectivity, proximity to major consumption centers, and access to a skilled workforce. TownAcre in Okhla Industrial Park is one such example that offers premium industrial spaces tailored for modern logistics operations.

Investment Opportunities in Industrial and Logistics Real Estate

- Direct Investment in Warehousing and Manufacturing Facilities

Investors can purchase land or built-up industrial properties to lease to logistics companies, manufacturers, or retailers. Commercial property in Delhi offers promising opportunities in this segment due to its economic significance and infrastructure advancements. - REITs and Institutional Investments

REITs focusing on industrial properties provide an alternative investment option, offering stable returns with lower capital investment. - Built-to-Suit and Sale-Leaseback Models Many companies are opting for built-to-suit facilities that cater to specific operational needs. Real estate developers and investors can capitalize on this trend by partnering with occupiers.

Role of Real Estate Firms and Developers

The best real estate company in Delhi will be the one that can navigate these challenges effectively while capitalizing on emerging trends. Leading real estate firms in Delhi are focusing on acquiring land in high-demand industrial zones, developing state-of-the-art logistics parks, and leveraging technology for efficient warehouse management. TownAcre in Okhla Industrial Park is a shining example of how modern industrial spaces can redefine logistics and warehousing efficiency.

Future Trends in Industrial and Logistics Real Estate

- Smart Warehousing and Automation – The adoption of AI, IoT, and robotics is transforming warehouse management and logistics operations.

- Sustainable and Green Industrial Parks – Companies are prioritizing eco-friendly warehouses with solar energy, rainwater harvesting, and energy-efficient designs.

- Growth of Last-Mile Logistics – As urban demand increases, small-scale distribution hubs are becoming essential for faster deliveries.

- Increased Private Equity Participation – The sector is witnessing growing interest from private equity firms and institutional investors.

TownAcre: Pioneering the Future of Industrial Real Estate

Industrial and logistics real estate is set to become one of the most attractive asset classes for investors. With Delhi NCR growing as a strategic hub, investing in commercial property in Delhi or a warehouse in Delhi NCR presents a promising opportunity for long-term growth. Real estate firms in Delhi that can adapt to technological advancements and evolving market demands will lead the way in this booming sector.

One such prime development is TownAcre in Okhla Industrial Park, which offers state-of-the-art logistics and warehousing facilities. With cutting-edge infrastructure and seamless connectivity to key transportation networks, TownAcre is rapidly gaining attention from investors and businesses looking for a strategic industrial base in Delhi NCR.

Related Articles:

Industrial Real Estate: The Backbone of Industry

Please Visit Our Social Media Handle for More:

FAQs:

Q. Is the real estate sector growing?

Ans. India’s real estate market was valued at approximately $477 billion in 2022 and is projected to reach $1 trillion by 2030.

q. Is real estate a good investment option in India?

Ans. Absolutely! Real estate can be a great investment option in India, as it offers appreciation potential, rental income, tax benefits, and diversification. o reach $1 trillion by 2030.